How to get Certificate of Origin with form ICO for exported coffee? – Certificate of Origin (C/O) with form ICO (International Coffee Organization) is a C/O form used exclusively for exported coffee.

However, there are many different types of coffee, and each type needs to be declared in a different set of ICO form C/O. Therefore, it is not easy to declare the C/O with form ICO declaration instructions.

Specifically how to declare C/O from ICO? Let’s find out with Helena Coffee Vietnam in the article below.

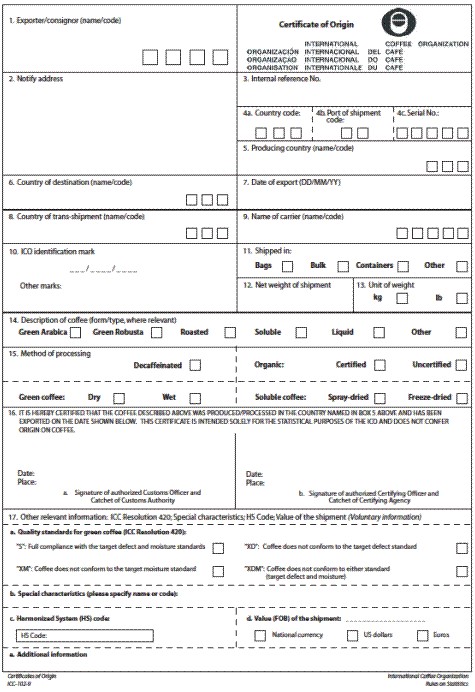

Certificate of origin C/O form ICO

Certificate of Origin with form ICO is issued by the Vietnam Chamber of Commerce and Industry (VCCI) in accordance with the regulations of the International Coffee Organization (ICO).

Certificate of Origin with form ICO used for coffee goods of Vietnamese origin exported to other countries. There are types of products: green coffee, green coffee, roasted coffee, instant coffee, and others.

If a shipment of coffee includes many types of coffee goods, it must be declared in multiple sets of C/O forms corresponding to each type of coffee.

Small quantities of goods for direct consumption on ships, aircraft, and other means of international commercial transport; and

Samples and packages with a net weight of green coffee not exceeding 60 kg or equivalent for other types of coffee, including the lookup function

(I) 1000 kg of dried coffee (dried coffee cherry) packed in a big bag

(ii) 60.7 kg of green coffee beans in a jute bag

(iii) 50.4 kg of roasted coffee; or

(iv) 23 kg of soluble or liquid coffee

A set of C/O samples ICO at least 4 copies:

- 1 white copy of ORIGINAL

- 1 copy of FIRST COPY – for use by ICO London in blue

- 2 copies COPY – for internal use only in white

Immediately after the VCCI signs the certificate of origin and the Customs signs the export certificate on box 16, the exporting unit returns to VCCI the FIRST COPY – for use by ICO London, 1 copy of the COPY – for internal use only, and a copy bill of lading to aggregate and send to the International Coffee Organization (ICO).

The exporting unit must keep a dossier of C/O form ICO (including 1 copy of COPY – for internal use only redwood) issued for not less than 4 years.

Instructions for declaring C/O form ICO

C/O form ICO consists of 2 parts PART A and PART B. Exporters only have to declare part PART A.

How to declare on the PART A section boxes as follows:

Box 1

Fill in the full name and address of the Vietnamese exporter (or consignor). Enter the number of the exporting (or consignment) unit issued by VCCI HCM in the 4 small boxes in the lower right corner of box 1.

Box 2

Fill in the name and address of the notification (consignee, importer). Fill in the corresponding identification number of the notifier provided by the exporter itself in the 4 small boxes in the lower right corner of box 2.

The exporter makes a LIST OF NOTIFICATION addresses & codes. APPLY according to the form. Each export consignment has a new consignee, the exporter manually fills in the code number (in ascending order from 0001), and the full name and address of this notifier on the list.

The list must be presented when applying for a C/O of the ICO form and a copy must be sent to VCCI HCM to summarize and send to the ICO.

Box 3

Enter the C/O number of the ICO form of the exporter in the coffee crop. Based on the date of exporting goods out of the territory of Vietnam: the coffee crop starts from October 1 every year and lasts until the end of September 30 of the following year.

For example, the coffee crop 2002-2003 started from October 1, 2002, to the end of September 30, 2003).

Box 4

Includes 3 small boxes Country code fixed declaration 145; Port code: export from ports in Ho Chi Minh City, declare 01; Serial No. C/O SAMPLE ICO number of the C/O issuer, which is self-monitored and provided to the exporter to declare.

Box 5

Enter the name of the country of manufacture (Vietnam) and fill in the 3 small boxes in the lower right corner of box 5 with the corresponding code (145).

Box 6

Enter the name of the destination country (importing country) and the corresponding code (see LIST OF COUNTRY NAME & CODORATION).

Box 7

Enter the export date as day/month/year (DD/MM/YYYY). For example, on June 31, 2003.

Box 8

Enter the name of the country of transshipment and the corresponding code. In case of direct conversion, declare DIRECT and leave 3 code boxes blank.

Box 9

Enter the name of the shipping vessel. Fill in the corresponding ship number issued by the exporter itself in the 5 small boxes in the lower right corner of box 9.

If not shipping by sea, fill in the necessary information about the means of transport used, for example, by truck (by lorry), by train (by rail), by plane (by air).

Exporters make a LIST OF TRANSPORTATION SERIES & CODORATIONS according to the form. For each export shipment transported by a new ship, the exporter manually fills in the code number (in ascending order from 00001), and the name of this shipping vessel is added to the list.

The list must be presented when applying for a C/O of the ICO form and a copy must be sent to VCCI HCM to summarize and send to the ICO.

Box 10

Fill in the —/—-/—- the following contents: 145 / VCCI-issued export unit code (like box 1) / C/O number of the ICO form of the application taste (like cell 3).

Fill in the Other marks section with other marks (if any).

Box 11

Enter an X in the corresponding box.

Box 12

Enter the net weight converted to kilograms. For example, export 18,23454 MTS (NW) and enter the number converted to kg: 18,234.54.

In case it is necessary to show other net weight such as a voucher, it must be clearly stated in brackets. For example: (18.23454 MTS).

Box 13

Enter an X in the kg box.

Box 14

Enter an X in the corresponding box. Specify the type and form of coffee if it belongs to another type of coffee. Note: each C/O form ICO only declares 1 type of coffee.

If a coffee consignment includes many types of coffee, it must be split into many corresponding ICO form C/Os for each type of coffee.

Box 15

Put an X in the corresponding processing method box (dry, wet, decaffeinated, organic).

Box 16

On the left, enter the date of signing the export certificate in the form DD/MM/YYYY, the place where the export certificate is signed, and the signature and seal of the customs office where the goods are exported.

For the convenience of comparison, re-inspection should specify the number and date of the export customs declaration at the top of this section, for example, Customs declaration for export commodities No. 26424/XK/KD/KV4 dated October 15, 2002.

On the right, fill in the date and place of signing the certificate of origin of the C/O issuing organization.